Mothers create song and dance extravaganza outside Lloyd’s of London to urge the insurer to stop harming children’s futures

Mothers created a song and dance extravaganza outside Lloyd’s of London HQ today (Monday 13 June 2022) to urge the…

Exposed: The Coal Insurers of Last Resort

Insurance contracts obtained by the Insure Our Future campaign show how utilities are struggling to find companies to underwrite new…

Utilities struggle to insure new coal power, contracts reveal

Inexperienced insurers now underwriting operating coal plants as mainstream companies increasingly exit market Utilities are struggling to find insurance to build…

Lloyd’s new ESG report: greenwashing, not climate action

Lloyd’s of London published its 2021 Environmental, Social and Governance (ESG) Report two days ahead of its Annual General Meeting…

Mums ramp up pressure on Lloyd’s to stop insuring fossil fuels

Parent groups, Mothers Rise Up and Parents For Future UK, are calling on Bruce Carnegie-Brown, Chair of Lloyd’s of London…

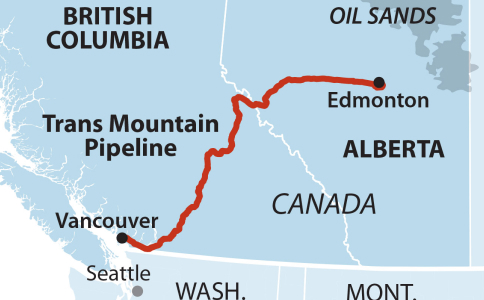

Arch becomes eighteenth insurer to sever ties with the Trans Mountain Tar Sands Pipeline

Number of insurers ruling out Trans Mountain continues to grow, following a year of climate impacts along the pipeline route…

Trans Mountain insurer Aspen commits to cut ties with the tar sands pipeline

Aspen joins sixteen companies that have ruled out insuring Trans Mountain Trans Mountain insurer and Lloyd’s of London syndicate Aspen…

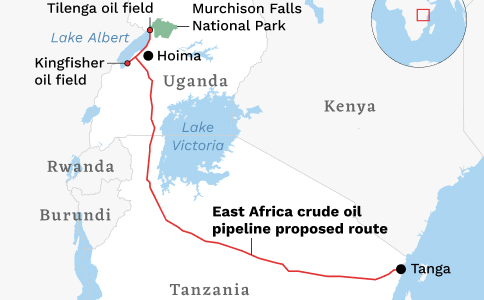

100 organisations call on Lloyd’s to reject EACOP

Nearly 100 civil society organizations working to advance human rights and environmental justice sent a letter to the Chairman and CEO of…

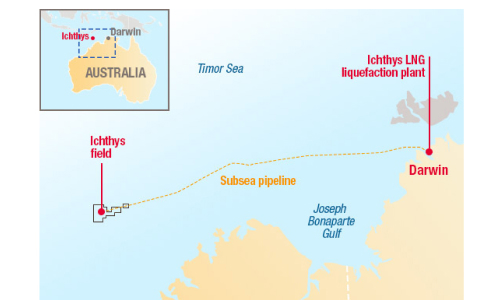

Why insurers should not support gas infrastructure, starting with LNG

Lloyd’s insurer Brit commits to never insure Adani

Lloyd’s ESG policy is small step, but they must drop all coal and new oil & gas, now

Coal is increasingly uninsurable in 2020, but industry fails to act on oil & gas

Lloyd’s insurer Apollo drops Adani Carmichael coal project

Hundreds joined online rally calling on Lloyd’s to #StopAdani

Lloyd’s must wash its hands of coal and tar sands

Coal Policy Tool sheds light on financial institutions’ coal policies

Insurers must end support for oil & gas projects to meet climate targets

Lloyd’s undermines climate targets with $460 million for tar sands pipeline

Insuring the unacceptable

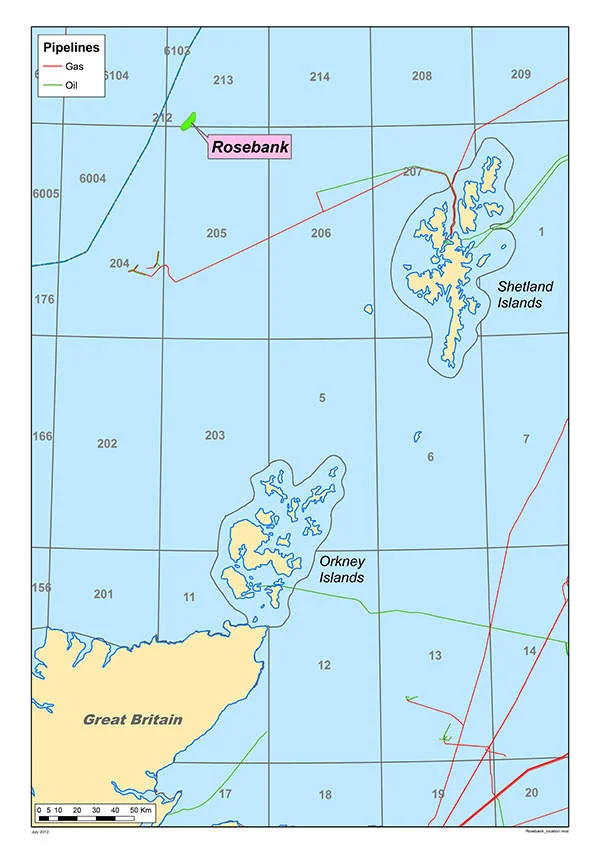

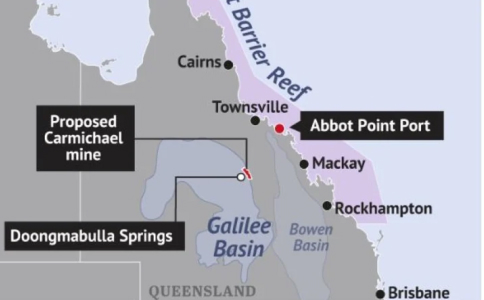

Lloyd’s is insuring some of the world’s worst fossil fuel projects that other insurers have dropped or refused to cover due to their climate impact. Stark examples of projects and companies that Lloyd’s should immediately prohibit all members of its market from renewing insurance for include: the Adani Carmichael coal mine in Australia, the Trans Mountain tar sands pipeline in Canada, the Rosebank Oil Field in the UK, Ichthys LNG in Austraila and the East African Crude Oil Pipeline – EACOP.

Lloyd’s should make a clear public commitment that its members will not renew insurance for these climate destroying projects when they come up for renewal in 2021.