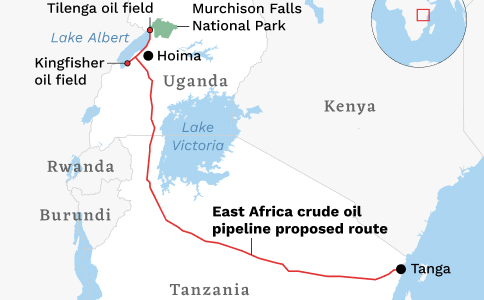

British and African Quakers urge against insurance for East African pipeline

In an open letter Paul Parker, recording clerk of Quakers in Britain, and Bainito Wamalwa, Africa section clerk of Friends World Committee…

Insurance CEOs have the power to stop fossil fuel expansion – they must not risk our planet for an extra squeeze of profit

As decision-makers converge in Egypt for the annual climate talks at COP, major new reports warn that we're at risk…

2022 Scorecard on Insurance, Fossil Fuels, and the Climate Emergency

Insure Our Future’s annual scorecard ranks the top 30 global fossil fuel insurers on the quality of their fossil fuel…

With new coal uninsurable, insurers start to move on oil and gas

62% of reinsurers now have coal exit policies and 38% have oil and gas exclusions as shift away from fossil…

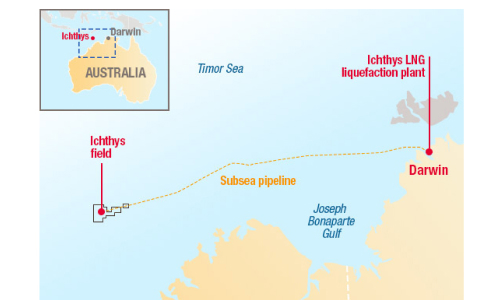

Exposed: Insurers of Ichthys LNG – one of world’s biggest gas projects

Will major insurers rule out support for Ichthys LNG’s expansion? One month before COP27, Reclaim Finance calls on global insurers…

Mums climate action at England-India cricket match: Chair of Lords & Lloyd’s told ‘fossil fuels are just not cricket’

A group of mums unfurled a huge banner at today’s England – India cricket match challenging Bruce Carnegie-Brown, Chair of…

Baden-Baden 2022: Time for reinsurers to stop fueling climate catastrophes and start accelerating the clean energy transition

From 23-26 October, underwriters and brokers from the global reinsurance industry will meet at the annual Baden-Baden reinsurance meeting in…

People from across the globe are coming together to demand #MarshDropEACOP

In May 2022, an investigative news article revealed that Marsh, the world’s biggest insurance broker, is approaching insurers and trying…

Lloyd’s failure to implement ESG policy is driven by its CEO John Neal

Meeting reveals Neal's failure to understand the need to stop insuring fossil fuel expansion On February 16, Insure Our Future…

Insure Our Future publishes leaked Lloyd’s ESG Guidelines

Insure Our Future exposes Lloyd’s roll-back of its stated climate policies and a blatant case of ESG policy greenwashing UPDATE:…

Insurers’ support for oil and gas undermines climate targets

Coal industry nearly uninsurable as U.S. & Bermuda companies provide last lifeline The global insurance industry is undermining efforts to…

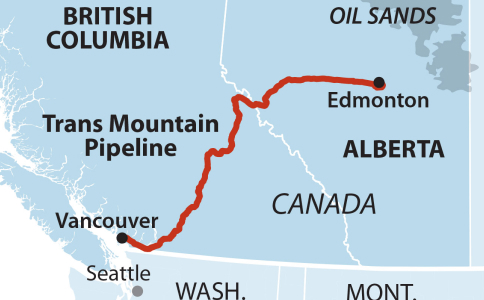

Lloyd’s syndicate rules out coverage for the Trans Mountain Pipeline

Lloyd’s of London’s climate roadmap falls short

Parents make Father’s Day appeal for Lloyd’s to stop insuring fossil fuels

Lloyd’s insurer Argo Group commits to cut ties with Trans Mountain Pipeline

Lloyd’s syndicate member Argo joins more than 10 other insurers that will not insure Trans Mountain, citing no “risk appetite”…

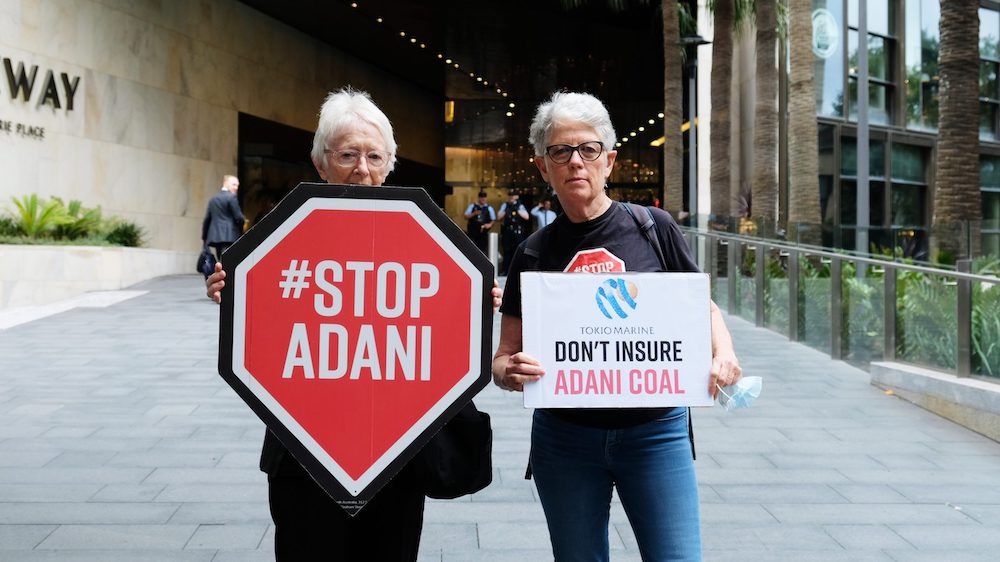

Climate campaigners protest AIG, Lloyd’s of London and Tokio Marine as coal insurers of last resort

Today, climate campaigners from across the world call on insurance giants AIG, Lloyd’s of London and Tokio Marine to immediately…

Canadian Energy Regulator approves Trans Mountain’s request to keep insurers’ secret

Coalition Denounces Decision, Pledges to Ramp Up Pressure on Remaining Insurers to Cut Ties with Trans Mountain Today, the…

Ten largest Lloyd’s insurers rule out underwriting Adani’s coal as Tokio Marine Kiln commits to not participate in ‘any future underwriting’

Campaigners call on Lloyd’s of London to immediately stop insuring the world’s worst fossil fuels projects

Campaign groups demand Lloyd’s stop insuring offshore oil drilling in The Bahamas

Insuring the unacceptable

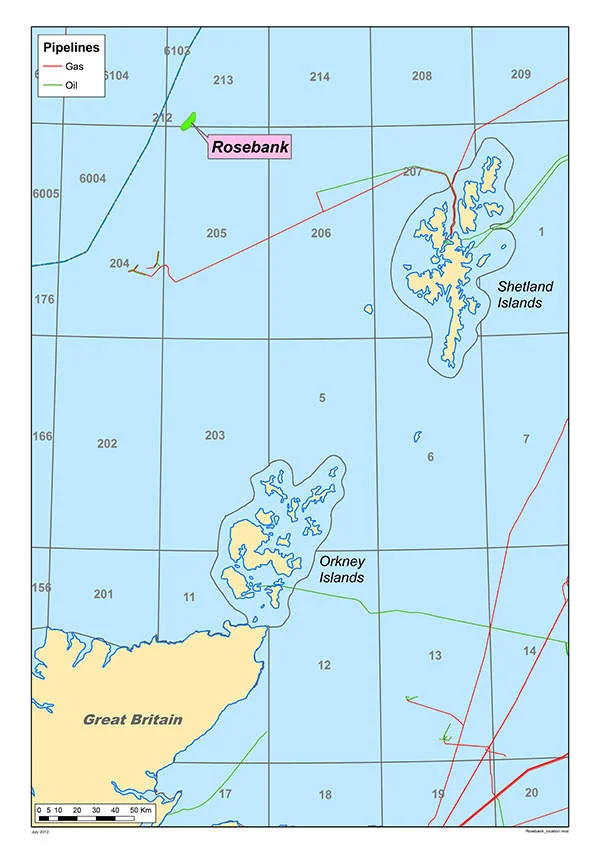

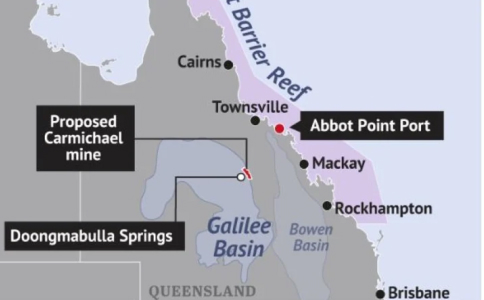

Lloyd’s is insuring some of the world’s worst fossil fuel projects that other insurers have dropped or refused to cover due to their climate impact. Stark examples of projects and companies that Lloyd’s should immediately prohibit all members of its market from renewing insurance for include: the Adani Carmichael coal mine in Australia, the Trans Mountain tar sands pipeline in Canada, the Rosebank Oil Field in the UK, Ichthys LNG in Austraila and the East African Crude Oil Pipeline – EACOP.

Lloyd’s should make a clear public commitment that its members will not renew insurance for these climate destroying projects when they come up for renewal in 2021.