Lloyd’s Market

Lloyd’s fossil fuel policy remains inconsistent with its net zero pledge.

Lloyd’s is failing to meet the litmus test for climate responsibility of stopping fossil fuel expansion. Despite its net zero pledge and claims that it is “the insurer of the transition”, Lloyd’s has no policy in place to end fossil fuel expansion and has failed to impose its existing, limited policy on its managing agents.

Lloyd’s published its first ESG policy in 2020. The policy was far from being aligned with a credible 1.5ºC pathway, but it did make a few specific climate commitments. In particular, the policy asked managing agents to stop insuring and investing in new coal, tar sands and Arctic energy projects starting in January 2022.

However, these commitments were watered down in Lloyd’s October 2021 guidelines to its managing agents and subsequent 2021 ESG report.

Also in October 2021, Lloyd’s joined the Net Zero Insurance Alliance (NZIA). The timing of Lloyd’s joining the NZIA, while watering down its ESG commitments, was viewed by observers in the climate movement as a greenwashing publicity attempt to distract from its backtracking on tangible steps to address the climate crisis.

Since the decline of the NZIA and Lloyd’s departure, Lloyd’s position on fossil fuels has not been strengthened. Boasting of their best half year profits since 2007 in September 2024, significant concern is raised by the inaction of the marketplace on climate.

Lloyd’s fossil fuel policy has so far only focused on coal and some unconventional oil and gas projects, which is inconsistent with the net zero pledge it has made as a member of the Net Zero Insurance Alliance (NZIA). To reach a net zero goal by 2050 following a 1.5°C pathway, the International Energy Agency (IEA) has projected the end of the development of new fossil fuel production projects beyond those approved in 2021.

Despite its initial ESG commitment, Lloyd’s continues to allow its existing managing agents to insure new coal mines.

Lloyd’s also does not make access to its market by new syndicates or managing agents conditional upon having their own policies that exclude insuring coal expansion.

Lloyd’s has yet to require or even propose any measures by its managing agents to address conventional oil and gas expansion.

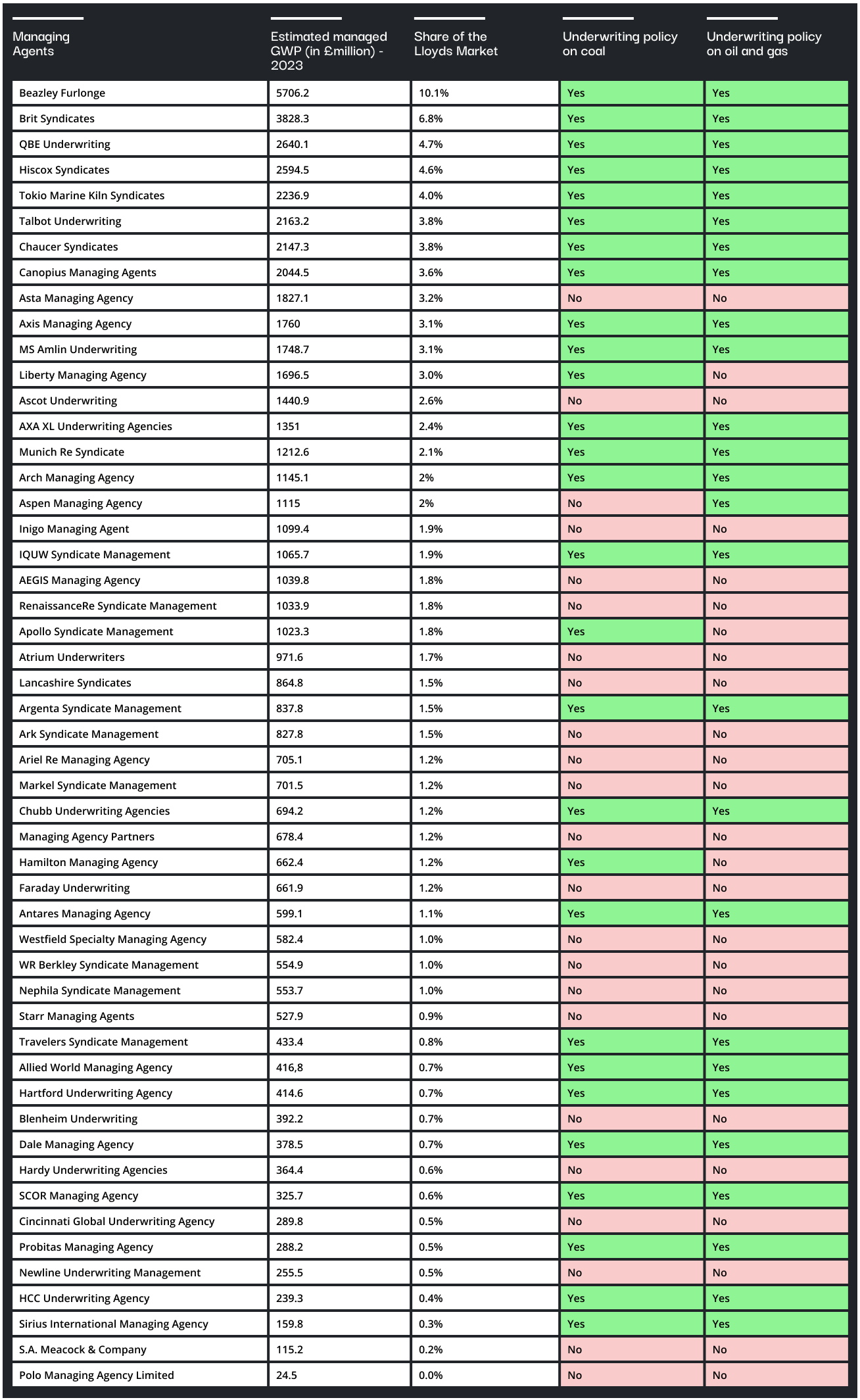

Comparison of all Lloyd’s of London Managing Agents’ fossil fuel commitments

Lloyd’s Managing

Agents:

Actions required to address policy failures.

Managing Agents

For more information about the climate policies of Lloyd’s managing agents and recommendations on how these can align with climate targets.

Climate Leaders? Or Insurers of Last Resort?

An increasing number of leading insurers and reinsurers have adopted substantive climate policies that, whilst not perfect, exclude insuring and investing in the most egregious fossil fuel projects and companies that are fueling the climate crisis.

Parent companies of a few Lloyd’s managing agents are amongst these industry leaders, including AXA XL, Munich Re, Argenta (Hannover Re).

In the wider London and global market, leaders such as Allianz and Swiss Re have also adopted substantive policies.

However at Lloyd’s, the lack of clear climate-science-aligned guidance provided by Lloyd’s to its members, and the apparent complete disregard for climate policy by many of Lloyd’s managing agents, shows Lloyd’s market to be more a market of last resort than a climate leader.

We call on Lloyd’s of London to update its fossil fuel underwriting guidance to its managing agents to ensure that they:

- Immediately stop offering any insurance services that support the expansion of coal, oil and gas production.

- Phase out within two years all insurance services for fossil fuel companies that are not aligned with a credible 1.5°C pathway.

- Immediately require Lloyd’s managing agents to align their policies and practices with the updated guidance.

- Establish clear enforcement mechanisms and sanctions if they do not comply.

- Condition the approval of any new managing agent’s business at Lloyd’s upon respecting this updated fossil fuel guidance.

- Annually monitor and transparently report on compliance and progress of its managing agents with regards to Lloyd’s fossil fuel guidance on coal, oil and gas.