Who is insuring exploratory drilling in The Bahamas, and why?

Lloyd’s has admitted they are providing insurance for the Bahamas Petroleum Company to drill for oil.

Lloyd’s ESG policy is small step, but they must drop all coal and new oil & gas, now

Lloyd's ESG policy is a small step in the right direction, but highlights that more ambitious and urgent action is needed.

Coal is increasingly uninsurable in 2020, but industry fails to act on oil & gas

Major companies in the U.S., the Lloyd’s market and East Asia are still insuring coal, and the industry has failed to exit oil and gas.

Insuring the unacceptable

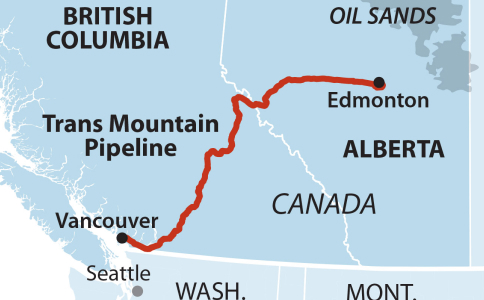

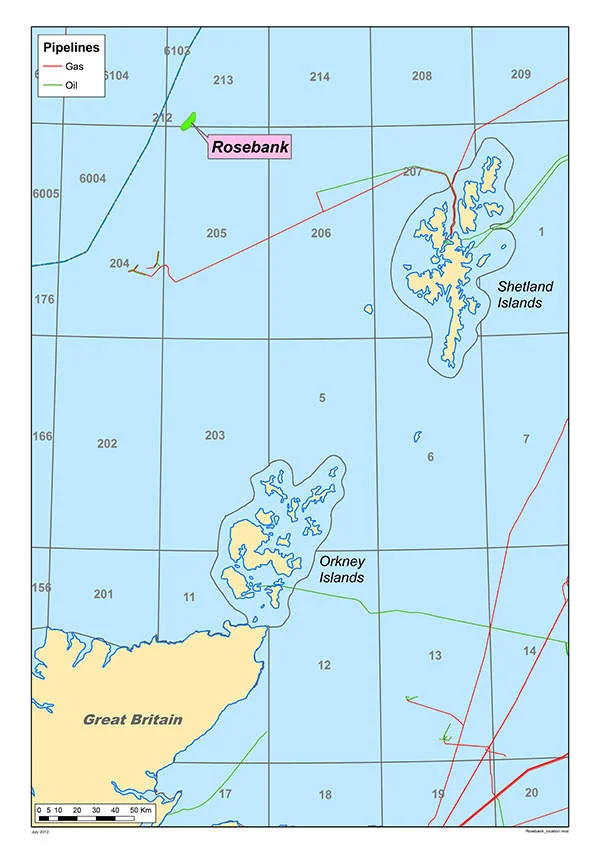

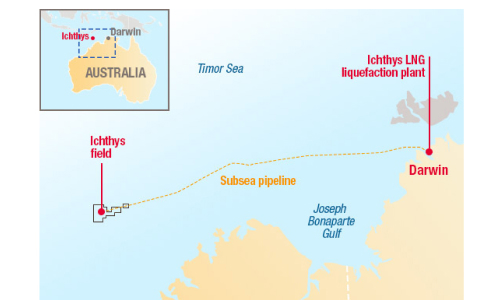

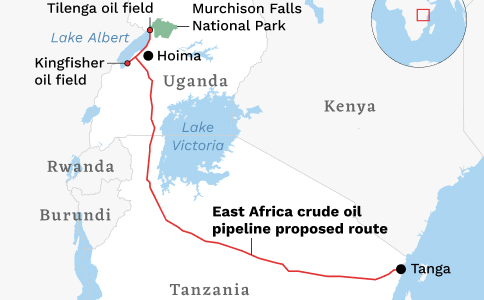

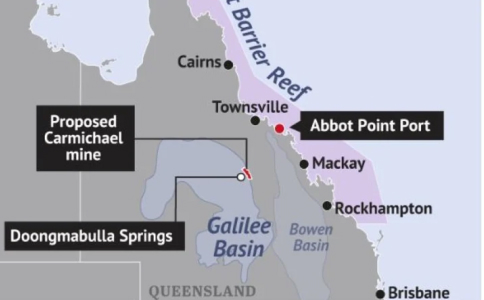

Lloyd’s is insuring some of the world’s worst fossil fuel projects that other insurers have dropped or refused to cover due to their climate impact. Stark examples of projects and companies that Lloyd’s should immediately prohibit all members of its market from renewing insurance for include: the Adani Carmichael coal mine in Australia, the Trans Mountain tar sands pipeline in Canada, the Rosebank Oil Field in the UK, Ichthys LNG in Austraila and the East African Crude Oil Pipeline – EACOP.

Lloyd’s should make a clear public commitment that its members will not renew insurance for these climate destroying projects when they come up for renewal in 2021.