About Us

Insure Our Future is a global network of campaign organisations and social movements with the shared goal of convincing the insurance industry to align their actions with climate science and social justice. The platform of actions that the network asks insurers to take is set out in an annual letter to the insurance industry. You will find the latest letter, which includes a list of current network members, on the Insure Our Future website here.

Insure Our Future’s

2023 platform

In line with the scientific consensus and appeals from the UN Secretary-General we, the Insure Our Future campaign call on insurers to take the following steps to support the global goal of limiting climate change to 1.5°C.

Credible 1.5ºC pathways need to give a higher than 50% chance of limiting global warming to 1.5ºC, should not rely on offsets and should only rely on negative emissions to a minimal degree, as reflected in the IPCC SR1.5’s Pathway 1 and the One Earth Climate Model (OECM) sectoral pathways report (as commissioned by Net-Zero Asset Owners Alliance).

- Immediately cease insuring new and expanded coal, oil, and gas projects.

- Immediately stop insuring any new customers from the fossil fuel sector which are not aligned with a credible 1.5ºC pathway, and stop offering insurance services which support the expansion of coal, oil and gas production for existing customers. Within two years, phase out all insurance services for existing fossil fuel company customers which are not aligned with such a pathway.

- Immediately divest all assets, including assets managed for third parties, from coal, oil, and gas companies that are not aligned with a credible 1.5ºC pathway.

- By July 2023, define and adopt binding targets for reducing your insured emissions which are transparent, comprehensive and aligned with a credible 1.5ºC pathway.

- Immediately establish, and adopt as policy, robust due diligence and verification mechanisms to ensure clients fully respect and observe all human rights, including a requirement that they obtain and document the Free, Prior, and Informed Consent (FPIC) of impacted Indigenous Peoples as articulated in the UN Declaration on the Rights of Indigenous Peoples.

- Immediately bring stewardship activities, membership of trade associations and public positions as a shareholder and corporate citizen in line with a credible 1.5ºC pathway in a transparent way.

- These policies should be applied by both insurance and reinsurance companies at the Group level. Reinsurance companies should apply the policies to direct, facultative and treaty business. Insurance services to be phased out include reinsurance for the captive insurers of the respective fossil fuel companies.

Background notes

on this platform

New or expanded coal, oil, and gas projects are defined as new coal, oil and gas extraction projects, power plants, transport facilities and other infrastructure (such as LNG terminals) that drive expanded extraction. This includes, but is not limited to, all oil and gas projects which had not yet received a Final Investment Decision (FID) by the end of 2021. Any company that is building new coal, oil or gas expansion projects is not aligned with 1.5ºC.

Oil and gas companies are defined as oil and gas producers, companies involved in oil services and equipment provision, oil transporting, oil trading, oil refining and processing, the production and transport of LNG and power utilities which depend on oil and gas for more than 20% of their revenue.

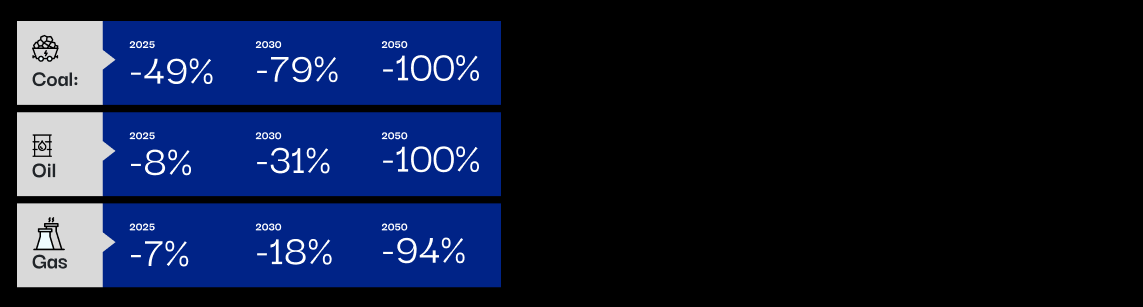

See the Global Coal Exit List and Global Oil and Gas Exit List for reference. Fossil fuel production must be reduced as follows compared with 2019:

All coal-related assets need to be closed by 2030 in European and OECD countries and by 2040 in the rest of the world.

Workers’ compensation policies, which directly benefit workers in the coal, oil and gas industry, renewable energy projects and operations which are ring-fenced from other energy and power sector projects and operations, and existing mine reclamation surety bonds should be exempt from this policy.

Insured emissions reduction targets need to set emission reduction targets for new projects as well as ongoing operations and need to define short- and medium-term targets (starting in 2025) across the entire commercial property & casualty portfolio. The targets need to cover all greenhouse gases and the scope 3 emissions of all carbon intensive sectors including coal, oil, gas and electric utilities. They need to aim for a reduction of insured emissions of at least 43% by 2030 (compared with 2019, as required according to the IPCC).

The FPIC policy should result in the ending of any insurance services for customers which fail to provide evidence that FPIC has been obtained for all projects on Indigenous lands and territories covered by the insurance policy.