Managing Agents

Lloyd’s: world’s leading insurance market is a climate laggard due to unrestricted managing agents.

Within the insurance industry, Lloyd’s of London stands out as the world’s leading insurance marketplace. But when it comes to climate emergency, Lloyd’s is better at signing initiatives than taking action such as restricting the fossil fuel underwriting of its managing agents.

Despite its market-wide commitment to reach net zero emissions by 2050, Lloyd’s is the last major insurance player in Europe without any commitment to reduce the support of its market for the development of new coal projects, new upstream oil and gas projects.

While Lloyd’s is responsible for deciding what risks are underwritten on its market, it fails controlling the risks related to fossil fuel expansion, risks that are inconsistent with its net zero pledge.

Despite Lloyd’s presenting itself as the insurance market of transition, nearly all its managing agents take advantage of a lack of regulation to continue to support fossil fuel expansion.

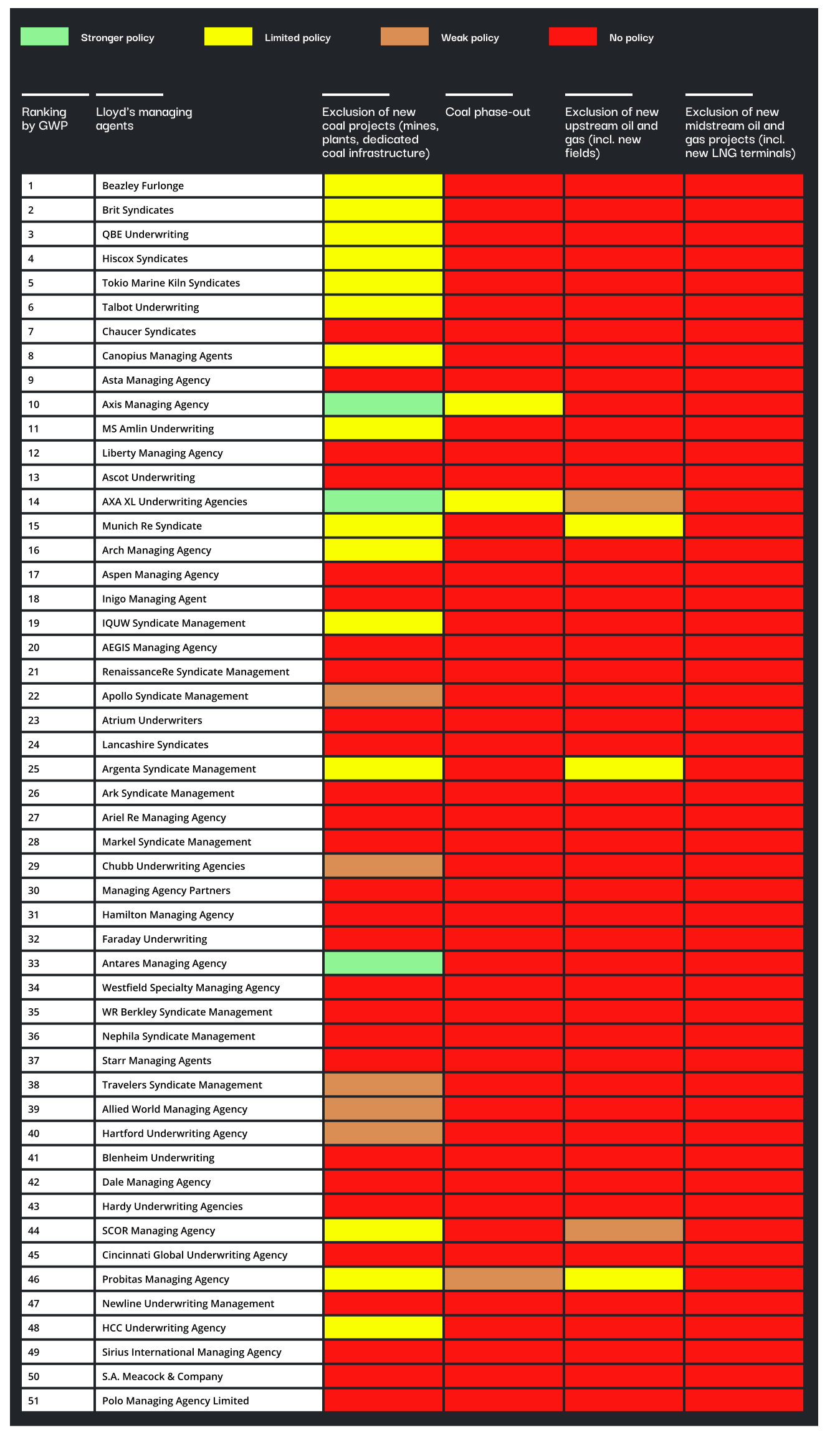

Only 5 management agents are “front runners”, with a commitment to stop underwriting risks related to new coal mines, new coal plants but also new oil and gas fields.

28 managing agents are “ultimate laggards”, without any commitment to stop underwriting risks related to new fossil fuel projects – such as Chaucer Syndicates.

18 managing agents are “slow movers”, with a commitment to stop underwriting risks related to new coal mines or new coal plants, but no commitment to stop underwriting risks related to new oil and gas fields – such as Beazley Furlonge, Hiscox Syndicates, MS Amlin Underwriting, Talbot Underwriting, Tokio Marine Kiln Syndicates.

Managing agent must take over Lloyd’s ambition to reach net zero by 2050.

Reclaim Finance’s report, alongside the Insure Our Future coalition more broadly, calls on each managing agent to adopt the most ambitious underwriting policy to avoid fuelling the climate risks by no longer providing (re)insurance to the development of new coal projects, new upstream oil and gas projects and new liquefied natural gas export terminal.

Lloyd’s must also finally use its power by defining a clear binding fossil fuel policy for all its managing agents.

Lloyd’s Council

and Corporation

Actions required to address policy failures.

Lloyd’s Market

For more information about Lloyd’s climate policies and recommendations on how these can align with climate targets.

Investors beware – read the policy

Many Lloyd’s managing agents do not have even the basics of a publicly available climate policy. Across the market, policies are inconsistent, not aligned with net zero pledges and bring the reputation of Lloyd’s market and its investors into disrepute.

If Lloyd’s and its managing agents hope to increase investment they must adopt climate policies that align with climate science. If not, the policy is effectively one of pursuing future climate and financial disaster.

Managing agents, be aware – we see you.

The climate movement has increasingly recognised the role of the Lloyd’s market and more specifically, its managing agents. This awareness continues to grow and with it will come more public scrutiny to managing agents’ policies and actions.

Managing agents – managing climate policy

- If you operate only or mainly in the Lloyd’s market and are able to set your own policies, then now is the time to step up and implement policies that align with climate science and credible 1.5°C pathways. See the Lloyd’s Market or the About section of this website for detailed policy suggestions.

- If your policies at Lloyd’s are set by a parent company, then raise the matter with them. See our Staff Action page for suggestions on starting the conversation. Help bring the entire company policy in line with climate science.

- Be of no doubt that the policy and actions of your managing agency will come under increasing levels of scrutiny and that you will be held responsible for your action or inaction, whether that be by Lloyd’s, regulators, investors or civil society.